Personal Loans

Let us help you out with personal loans, you sometimes need a little financial help. While borrowing money from those near and dear could sometimes be a viable solution, it may not always be too good for your image.

What are personal loans?

Personal loans are unsecured personal loans that you can take out from licensed moneylenders like us to meet short-term financial needs, such as taking care of an unexpected medical bill, a utility bill, or car repair expenses. No collateral (an item of substantial value such as a luxury timepiece) is needed from you for us to grant you the personal loan.

Depending on your level of salary, we can offer up to four times your monthly salary and a flexible repayment scheme.

Why choose us for your personal loans?

– A focus on your ability to repay – not on your credit history

One feature that has made this type of short-term financing method so attractive to many people is that we focus mainly on your ability to repay instead of your credit history. Other conventional lending institutions such as banks will conduct stringent credit checks on personal loan applicants, and those with a not-so-stellar credit history can be expected to be turned away. We, on the other hand, assess each borrower based on his or her ability to repay the loan, and any personal loan we do grant is commensurate with his or her level of income. This means that even if you do not have an excellent credit history, you can still get the financial help you need with a personal loan from us.

– Competitive interest rates and flexible repayment terms

We believe every individual should be able to access financial help when he or she needs it. Our personal loans are designed to improve your cash flow, not make it more difficult for you to manage. Feel free to compare our interest rates with other moneylenders in Singapore – you will realise that we are among the most competitive. Talk to us about your requirements – we have a range of flexible repayment terms, and are able to tailor a repayment plan that works best for you.

– Fast approval

As we understand you cannot afford to wait around for weeks, or even months, for your personal loan to be approved before you receive the cash, we do not conduct strict credit checks, which can be very time-consuming. This means you can be getting a low-interest personal loan within one to two working days to allow you to swiftly settle that medical or utility bill.

We do, however, check on several aspects to ensure that we are granting you a loan amount that is not going to overburden you when repayment time rolls around. Find out below what documents you need to prepare when applying for a personal loan with us.

Eligibility and how to apply for a personal loan with us

Scroll right to view this table

| Applicant | Requirements |

|---|---|

| General eligibility (applicable to all applicants) | – Must be at least 21 years old – Must be a citizen or permanent resident of Singapore – Should be employed, or have a recurrent stream of income |

| Individuals receiving salary or/and commission | Documents to prepare: – NRIC – Bank statements for the last 3 months – Latest payslip |

| Self-employed | Documents to prepare: – NRIC – Bank statements for the last 3 months – Income Tax Notice of Assessment for the last 2 years – Latest ACRA business profile – Financial statements of the company for the last 6 months. |

SCAM ADVISORY

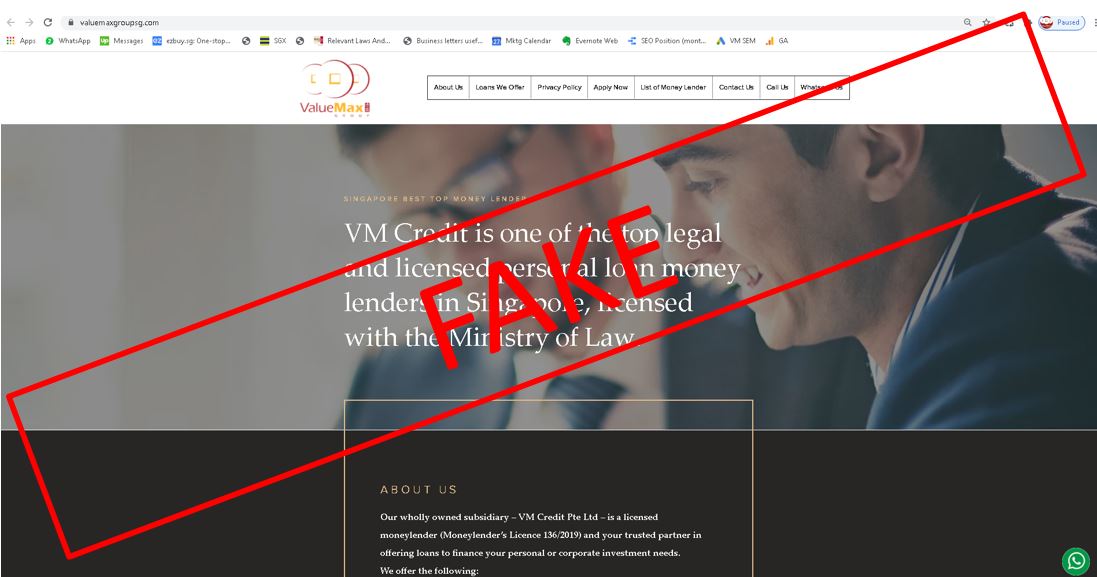

Members of the public have reported to us that they have received suspicious calls/ text messages/emails from scammers impersonating loan officers from VM Credit. We have also found a fraudulent website: https://www.valuemaxgroupsg.com/ as shown in the screenshot below.

VM Credit Pte Ltd would like to advise members of the public on the following:

- We only have ONE branch operating at 261 Waterloo Street #01-31 Waterloo Centre Singapore 180261. Telephone number: +65 6481 1788

- Our official website is www.valuemax.com.sg.

- We do NOT make any cold calls or send any unsolicited text messages and emails to members of the public. Do not respond to these calls, messages and emails.

- We do NOT ask for your personal information such as NRIC, SingPass or bank account details through calls, text messages and emails.

- We MUST first meet you in person physically at our office stated above before granting you a loan.

- We will NOT ask a loan applicant to make any payment before loan disbursement.

FAQ

Q1 | What is the minimum and maximum period for repayment?

Our minimum period (More than 60 days) and the maximum period for repayment is 12 months.

Q2 | What is the maximum annual percentage rate (APR)?

Under MONEYLENDERS RULES 2009, the maximum interest rate moneylenders can charge is 4% per month.

The computation of interest charged on the loan must be based on the amount of principal remaining after deducting from the original principal the total payments made by or on behalf of the borrower which are appropriated to the principal.

[To illustrate, if X takes a loan of $1,000, and X has repaid $400, only the remaining $600 can be taken into account for the computation of interest.]